More than 25 percent of CFOs expect to merge with or acquire another business this year.

If you’re among those planning to buy or sell, your odds of success will improve greatly by paying attention to integration issues before — and after — your deal closes.

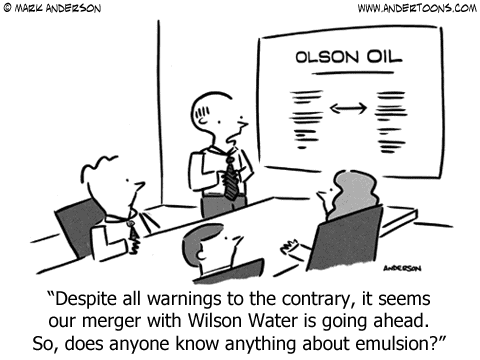

According to a corporate board member magazine study, failure to effectively integrate the merging companies into one is the most-often cited reason mergers and acquisitions transactions fail.

The study notes that if employees from the organizations are unable or unwilling to work together, effectively and efficiently, the combined entity won’t achieve its expected cash-flow and cost-saving synergies, causing the buyer to overpay.

So before the deal closes, it is critical for management to address such integration issues as:

- Which company’s administrative policies and procedures will the new entity follow?

- Which entity’s standard employment arrangement — including benefits, perks and contractual restrictions — will prevail?

- Which locations will close or merge with another?

- Whose positions can be eliminated or combined?

- Which computer system will become the standard for the combined entity?

- Are there any assets or divisions that the buyer plans to divest within the next year?

Another important part of post-deal integration is promptly renegotiating contractual agreements with suppliers, customers, employees, lenders and other stakeholders. In some situations, the buyer may need to obtain consent to assign contracts to a new owner.

Integration is not the only challenge faced when dealing with mergers and acquisitions. There are also Tax Complications and Accounting Issues to consider.